🏡 2-1 Buydown Program Explained:

How to Lower Your Monthly Mortgage Payment Today!

Need ALoan Officer/ Realtor? Text or Call (714) 380-4140

APPLY HERE: 100% FREE QUOTE

Still seeing mortgage rates in the high 6% or even 7% range?

You're not alone—and you’re not out of options either.

One of the smartest strategies homebuyers are using in 2025 is the 2-1 Buydown Program. This creative financing tool can lower your interest rate for the first two years of your mortgage, helping you ease into homeownership with more affordable monthly payments—especially in a high-rate market like today.

APPLY HERE: 100% FREE QUOTE

As a seasoned loan officer in California, I’m here to break it down for you in 4 simple steps—and help you decide if it’s right for you.

📉 What Is a 2-1 Buydown?

The 2-1 buydown is a temporary interest rate reduction that lowers your rate by 2% in year one and 1% in year two before it returns to the full fixed rate in year three.

For example:

If your actual fixed rate is 7.25%,

Year 1 = 5.25%,

Year 2 = 6.25%,

Year 3 and beyond = 7.25%

👉 It’s often paid for by the seller, builder, or even negotiated by your agent and lender (that’s where we come in).

Ready to Apply? SEE IF YOU QUALIFY: 100% FREE QUOTE

✅ Top 4 Steps to Get a 2-1 Buydown Loan

1. Talk to a Knowledgeable Loan Officer

Not all lenders offer buydown programs—and not all agents know how to negotiate them. Work with a team who gets it and knows how to structure these deals.

2. Get Preapproved with a Participating Lender

Let’s run the numbers! We'll preapprove you and calculate how much you'll save each year with a buydown—sometimes it’s hundreds per month.

3. Negotiate Seller Concessions or Builder Incentives

Sellers are often willing to offer closing cost credits in today’s slower market. These can fund your buydown! Builders, too, often have incentives available.

4. Close With a Customized Loan Plan

We’ll finalize your loan with the reduced rate structure, walk you through your amortization plan, and make sure you’re set up for success when the full rate kicks in.

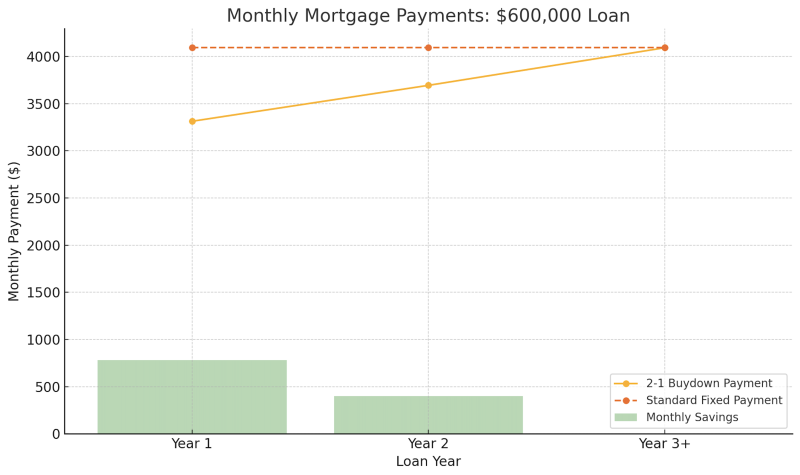

Chart of monthly savings vs. standard fixed-rate loan

(Example ONLY)

Here's the chart comparing monthly mortgage payments on a $600,000 loan using a 2-1 Buydown vs. Standard Fixed Rate:

Year 1: $5.25% rate – Save approx. $763/month

Year 2: $6.25% rate – Save approx. $398/month

Year 3+: Back to fixed 7.25%

"Ask Me About 2-1 Buydowns" Text OR Call (714) 380-4140

💬 Final Thoughts

You don’t have to wait for rates to drop to make your move. Let’s get strategic—and make the market work in your favor.

The 2-1 Buydown is one of the best-kept secrets buyers are using to win in 2025.

📲 Ready to learn more or see if you qualify?

Click Here Apply Here for a 100% FREE quote

Let’s connect and explore your options together!

Text or Call (714) 380-4140

#2to1Buydown #MortgageHelp #LoanOfficerCalifornia #BuyDownExplained #FirstTimeHomebuyerTips #CreativeFinancing #MortgageStrategy #SoCalHomes #InterestRateRelief #SellerConcessions #LoanPrograms2025 #SunMortgage #SunRealtyGroup