🪖 VA Loan Co-Signer Rules: What You Need to Know Before Applying

VA loans are one of the best benefits available to U.S. veterans and active-duty service members. But what if you can’t qualify for a VA loan on your own? Can you add a co-signer?

The answer is yes—but there are important rules and restrictions. Whether it’s a spouse, family member, or a fellow veteran, not all co-signers are treated the same.

✅ 1. You Can Have a Co-Signer on a VA Loan

If you need help qualifying—because of income, credit, or debt-to-income ratio—you can have a co-signer. However, VA loans require co-signers to live in the home and be either your legal spouse or another VA-eligible borrower (like a fellow veteran).

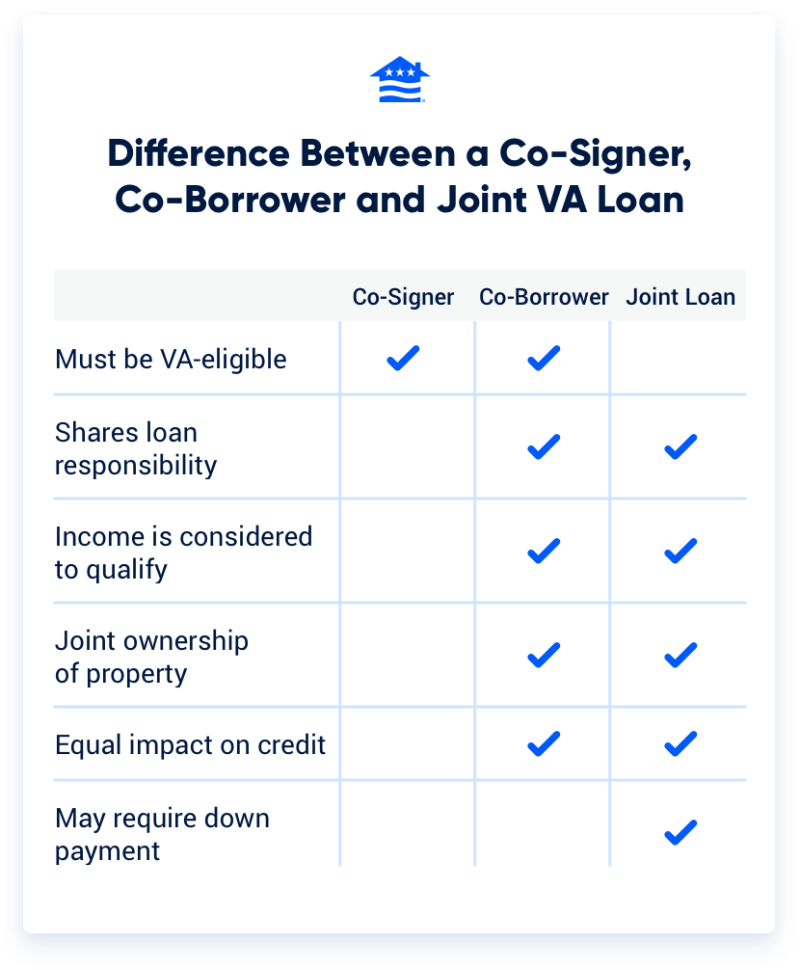

🔍 2. Co-Signer vs Co-Borrower: What’s the Difference?

Co-Signer: A backup on the loan, not on the title. Their income may not count toward qualifying. They only step in if you default.

Co-Borrower: Fully on the loan and the title. Their income, credit, and assets help you qualify—and they share ownership of the home.

Having a co-borrower can make you eligible for a larger loan amount since their finances are factored into the approval.

🚫 3. What About Non-Spouse or Non-Veteran Co-Signers?

If you want to add someone who isn’t your spouse or another veteran—such as a parent, sibling, or unmarried partner—you can still apply, but the VA will only guarantee your portion of the loan.

This means:

You’ll likely need a down payment (usually around 12.5%).

The loan becomes partially VA-backed, which may affect loan approval and terms.

This option is possible, but less common and less favorable.

❤️ 4. Ideal Co-Signer Options: Spouses & Fellow Veterans

Apply Here

Spouses: Can co-sign or co-borrow with you without affecting your VA loan benefits.

Other VA-Eligible Borrowers: You can share or split VA loan entitlement, maximizing your buying power and still qualifying for $0 down.

📝 Summary: Know the Rules Before You Add a Co-Signer

✔️ Co-signers must be a spouse or VA-eligible co-borrower who lives in the home.

✔️ Non-VA, non-spouse co-signers require a down payment.

✔️ Co-borrowers can boost approval odds and share ownership.

If you’re considering using a co-signer on a VA loan, it’s crucial to understand the impact it can have on your loan structure, down payment, and eligibility. At Sun Mortgage, we walk you through the options and help find the solution that works best for you.

🇺🇸 Ready to Find Out If You Qualify? Apply Here

Whether you're applying solo, with a spouse, or co-signing with another vet—we’re here to help you navigate your VA loan with ease. Let’s get you pre-approved with no obligation.

📞 Contact us today, text OR call (714) 380-4140 to explore your VA loan options and start your journey to homeownership!

VA loan co-signer rules, VA co-borrower guidelines, can I have a co-signer on a VA loan, VA loan spouse co-borrower, VA loan for unmarried partners, VA loan down payment rules, veteran home loan, VA loan eligibility, VA home loan with co-signer, co-borrower requirements for VA loan, VA mortgage help, Sun Mortgage VA loans

#VALoan #VeteranHomeLoan #CoSignerRules #VAHomeBuying #MortgageHelp #SunMortgage #MilitaryHomeLoan #HomeLoansForVets #SpouseCoBorrower #VALoanApproval #VeteranMortgageOptions #HomeLoanTips #RefiWithVA #VAEntitlement #CaliforniaMortgageBroker